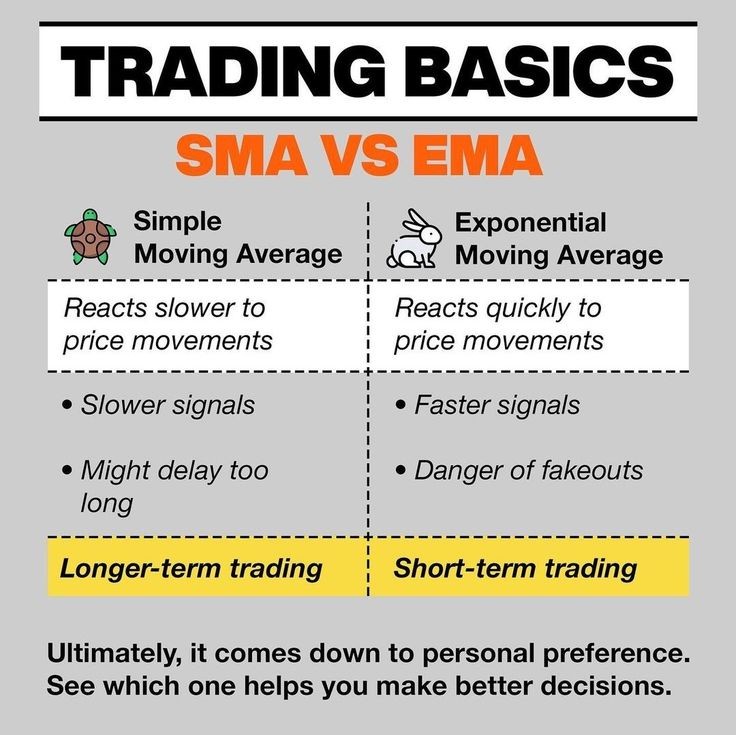

There are several different methods for that and the three most common are the following: Once you have calculated true range for each bar, the next step is to calculate the average of these, which is the ATR that we want. where H, L, C 1 are high, low, and previous close, respectively.įor more detailed explanation of true range and some graphical examples, see True Range and How It Differs from Range. High minus low (like traditional range).If you want to understand and calculate ATR, you first need to understand and calculate true range, which is the greatest of these three: use Bollinger Bands in conjunction with EMAs).Average True Range, as its name suggests, is the average of true range. It will take some experience and a cluster of indicators to help you avoid the fake-outs (i.e. On the other hand, using the EMA indicator will aid you in catching a trend as it starts, but if you are a slow trader, you risk getting caught up in fake-outs of price spikes. However, I personally don't rely on SMA's when looking at charts and making trading decisions. While the SMA is slow to respond to price action, using this indicator may help you avoid many fake-outs. In conclusion, it is right to say that each trend has its own merits.

It’s a useful indicator for trading short-term momentum, with its major benefit being the speed with which it reacts to the markets. EMA reduces the effect of the lag that comes from using previous price data by using current data. VerdictOver the years in my trading career, I have learned that EMA is typically smoother and more accurate hence the potential to provide a higher number of relevant results. Traders need to try out different strategies and backtest the chart to see which makes more returns with all types of moving average of 10, 5, 20, 50, 200 SMA, and 200 EMA. SMA’s will give you an overall view of trends making it easier to identify fake-outs.

This makes it a good trend indicator, as it remains short when the price is below the SMA and long when the price is above it. The SMA, with its slower lag, tends to smooth price action over time. A price spike therefore may send the wrong signal of a forming trend. The same features that make the EMA a better choice for short-term trading make it less effective when it comes to long-term trading.Ĭonsidering that the EMA will move with price sooner than the SMA, it often makes a sudden switch in price direction. SMA is most useful for long-term trading while EMA is more useful where there is short-term price movement. The longer the time period, the slower it is for the moving average to react to movement in price. Sometimes, for a particular period of time SMA reacts better and sometimes EMA does. Each stock or index has its own frequency (use backtesting experiments to figure it out). It depends on factors like a trader’s style of analysis, objectives, and time horizon. The formula for working out the multiplier, which is then used in the calculations for EMA is as below:Įven though SMA and EMA show distinctive differences, that does not mean one is superior to the other.

A multiplier is then added, this increases the weighting of the newer price data. To work out an EMA, you start with the SMA data.

closing prices from the last ten days), you will add these together and divide the total by ten. That is, if you have ten price inputs (i.e. In the instance of an SMA, these inputs will be closing prices. SMA as exactly as the name implies is the average of a set number of inputs, as chosen by the trader. The SMA gives an average price of a security over a certain period. The difference between SMA and EMA becomes noticeable when comparing long-term averages. Simple Moving Average determines an average of price data whereas Exponential Moving Average gives more weight to recent price data. Both SMA and EMA are used to measure the direction of price over a given period or spot any trend reversals. The most common types of moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). Moving averages are technical indicators used by traders and investors to define the current price direction rather than predict the price direction.

0 kommentar(er)

0 kommentar(er)